Live Statistics of FXParabol with the Real Money Results

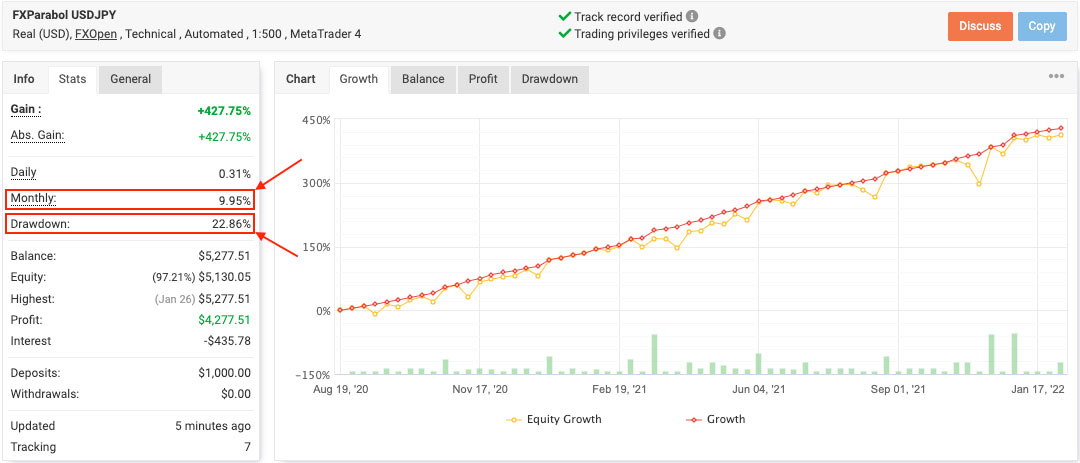

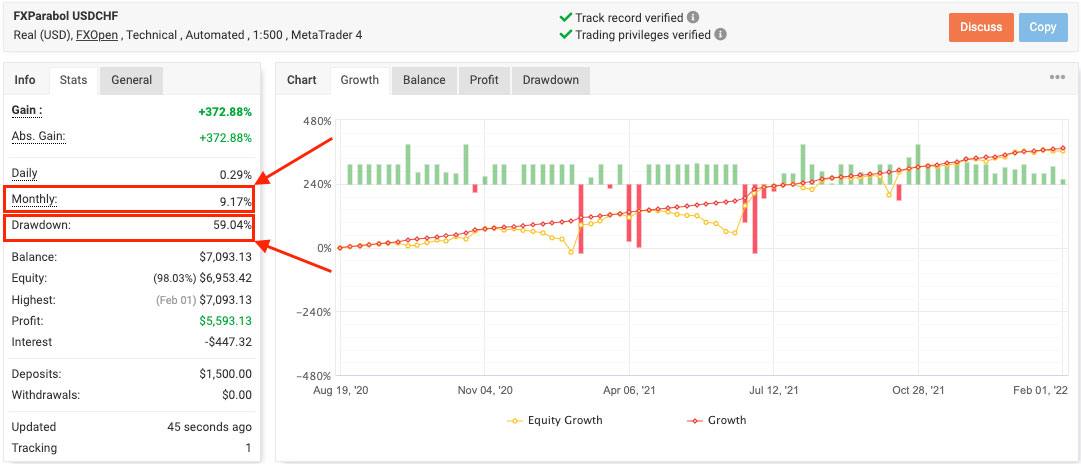

The FXParabol EA has got two real live trading accounts on Myfxbook service where it trades on different currency pairs – EURUSD, USDJPY and USDCHF. Both accounts have been trading live since August 19, 2020, which allows us to analyze approximately 1.5 years of live trading. Starting with the initial deposit of $1000 and $1500 the FXParabol EA has reached profits of 427% and 372% respectively. Looking at the smoothness of the graphs, we have to admit that this Forex robot has been able to keep its trading graphs clean from deep fixed drawdowns and significant losses. Graphs look strongly moving up and show no signs of sharp-edged movement.

FX Parabol EA Backtest

FXParabol USDJPY Aggressive

FXParabol USDJPY Normal

FXParabol USDCHF Aggressive

FXParabol USDCHF Normal

All the backtests are made on a 1H timeframe using every tick testing model, which is the most precise method of backtesting based on all available least timeframes. The backtests’ modeling quality is 90%, which is okay for this EA because it does not use a scalping strategy. The system was tested on the historical quotes from 2015 and 2016 respectively for USDJPY and USDCHF currency pairs, which gives us results of 6 and 5 years of backtesting.

Profitability & Drawdown

Type of Trading

- The Parabolic SAR is the trend indicator that creates rows of dots under or above the price graph and shows the direction of the trend. Sometimes the line formed by the Parabolic SAR markers is considered as a dynamic support or resistance level. However, Parabolic is not just a trend-following indicator. It is also designed to determine trend reversal points (SAR stands for “Stop and Reverse”). A candle, on which the Parabolic marker moves from top to bottom or vice versa, is considered a reversal one.

- The Bollinger Bands is another indicator used by FXParabol EA, which is also the trend indicator. The indicator consists of 3 lines, the task of which is to measure the current market volatility. The middle line is the usual Moving Average. The distance of deviation of the upper and lower lines from the middle line proportionally depends on the price action. The higher the volatility, the stronger the deviation and the wider the corridor. The lower the volatility, the smaller the deviation, and the narrower the corridor.

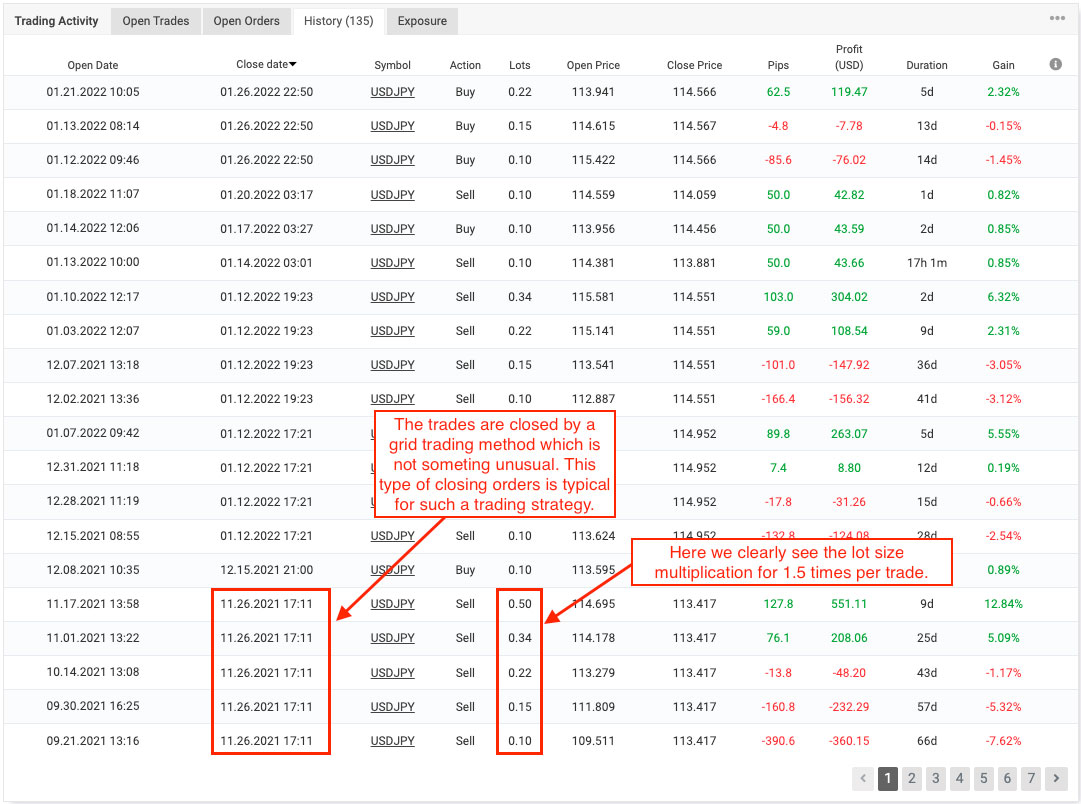

- Well, not only, the combination of these two indicators is used in FXParabol EA to detect a trend and pick the perfect timing for the trade execution. The robot also uses a specific math algorithm that allows the system to compensate for losing trades.

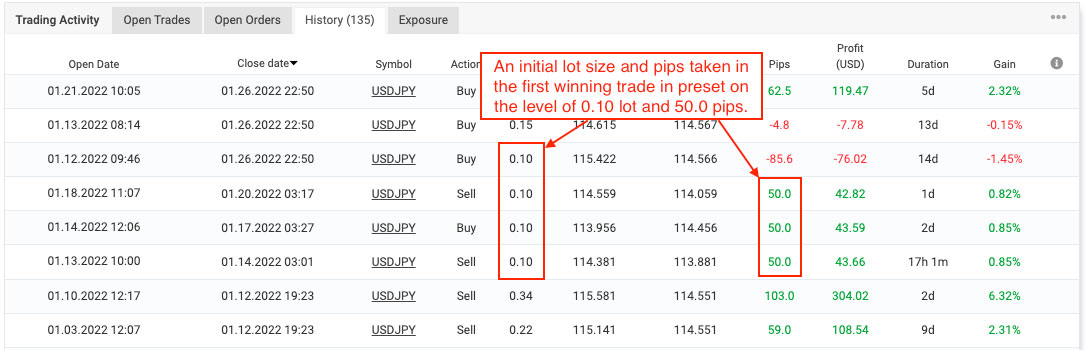

Another thing that we can obviously admit about the robot is that the FXParabol EA uses a preset level of lot size and pips taken per every first winning trade. This is clearly seen from the following screenshot. The lot size for every first winning trade is usually 0.10 and the amount of taken pips is 50.0 pips.

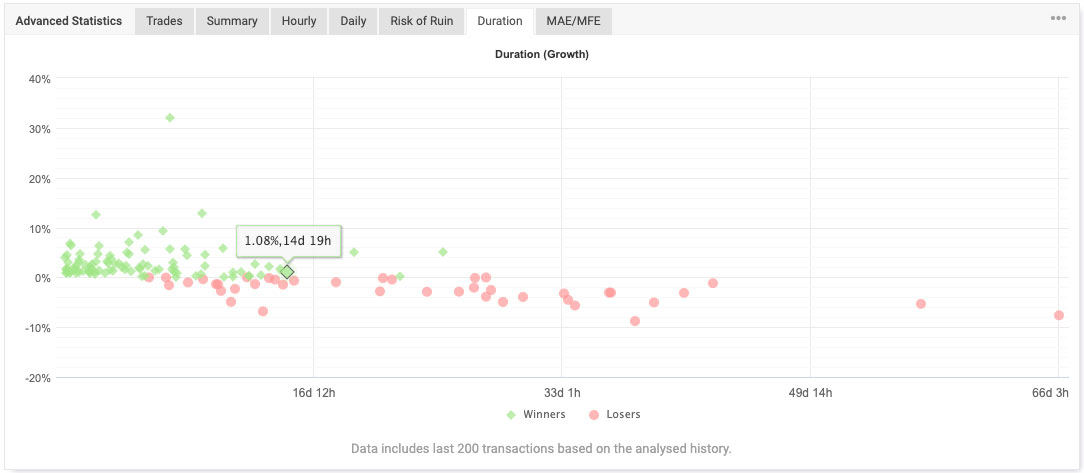

The duration of trades being opened for FXParabol EA is in the range of 1 hour to 15 days. This means that the system can and would be keeping trades open to reach the desired gain level. FXParabol EA is not the system that would be closing deals a few times every day. Also, it is seen from the screenshot below that usually the trades that are kept open by this Forex robot longer than 15 days become losing once. The most profitable trading periods range for FXParabol is from 1 hour to 5 days. There are no losing trades closed in this period during the trading history of the system.

Conclusion

FXParabol EA Purchase includes

Buy to Get:

- 1 license for any account

- Versions for MT4 and MT5

- Free lifetime updates

- 24/7 reliable technical support